The designation of the problem

The rapid development of the global digital space, the powerful influence of innovative achievements on this process, even taking into account the unprecedented sanctions impacts in the economic field on our country from Western “partners” as our President calls them, in the context of conducting a special military operation, e-commerce – aka e-commerce or e-commerce – continues to gain momentum.

It should be noted that at present information and electronic support /support at all levels of human activity is perceived as a common phenomenon, including in Russia. In the conditions of a new level of digital environment, the Russian e-commerce market is actively manifesting itself, which, despite everything, is growing at an accelerated pace every year, changing the mentality of the trading community around the world. The main components of the digital environment are search engines, mobile applications, social networks, websites, cloud servers, audio and video resources and other web resources that are integrated and implemented for the global community [1].

In less than the last five years, the number of orders through large online stores in Russia has increased by 78% to 405 million rubles, and turnover to 721 billion rubles a year. The volume of the rest of the online market (excluding food and medicine sales) increased by 37% to 1.7 trillion rubles [2]. In 2020, against the background of the restrictions associated with the pandemic, but the expansion of the digital environment significantly increased the number of FMCG products sold (essential goods, medicines, food, etc.).

The purpose of preparing the article

The authors, through the prism of new approaches, namely, approaches adopted in economic sociology, studying the behavior of social groups in economic activity, the processes of obtaining and using funds and other assets [3], present new views on the analysis of such an economic phenomenon as electronic commerce in the context of the development of the digital environment. The novelty of the approach, in particular, consists in an attempt to explain what role economic structures and socio-economic institutions play in society in the process of organizing and developing the scale of a relatively new type of trade – electronic commerce, as well as what impact digital environment, as a field of application, against the background of the rapid development of this type of human activity, has on the character of economic structures and social institutions.

The empirical basis for the preparation of the article was the secondary analysis of statistical data from the websites of the analytical company Data Insight, the World Trade Organization, the World Bank and official statistical services; textbooks and publications, estimates and forecasts of domestic and foreign experts in the field of electronic commerce; as well as estimates and forecasts of foreign and Russian analytical agencies, research companies published in open sources.

Electronic commerce and characteristics of its features

The socio-economic cataclysms of recent years, some disruptions in socio-political life, the conduct of a special military operation in Ukraine have made serious adjustments to the development of the European electronic market. But, despite all these obstacles, it is rapidly developing in the digital environment, and the level of penetration of e-commerce into the market, and not only European, is already 15-30%. The cumulative additional increase due to the factors of the pandemic over. These years will amount to 4.4 trillion rubles out of 23.3 trillion rubles of the total market volume over these years, this area has more than 293 million users, and the market is estimated at 269 billion euros [4]. According to forecasts, the average growth rate of the e-commerce market will be ~10-12% annually until 2030, while it differs greatly by country [5].

Due to the impact of the Covid-19 pandemic in 2020/2021, the demand for the delivery of not only vital goods (listed above), but also other goods has sharply increased. In conditions when, in order to comply with quarantine requirements, when almost all consumers had previously been accustomed to retail stores were either closed to the public, or admission was significantly difficult, and people had no choice but to learn how to buy online. It is known that where there is demand, there is also supply. Businessmen and entrepreneurs, in turn, learned how to use the digital environment competently and sell their product on online platforms, were quickly able to monetize this space and a new business direction. A new social space is being created, where the main point of contact between the seller and the customer-buyer is the marketplace, which until recently did not enjoy such consumer popularity. The socio-role positions between the subjects were distributed quite simply, almost according to the old scheme: for the seller, the marketplace platform acts as an intermediary between him and the buyer (acquirer), and for the buyer (consumer) himself, the platform acts as a hypermarket, where at one address, significantly saving time, which is more spent on moving to the store there and back, the choice of goods, you can buy a variety of goods – from food and clothing to oversized furniture, electronics, etc., without leaving home.

To date, optimized applications and websites have been created on which individual sellers or stores can place their products, and the platform in the digital environment, thus, solves all the problems of their communication.

The practice of economic sociology clearly shows that such a sales model quite powerfully optimizes operational models (for example, the FBO and FBS models have improved qualitatively and gained a foothold in the market) FBO (or Fulfillment by Operator, delivery from the marketplace warehouse) is a model in which the seller packs, labels and takes a batch of goods to the marketplace warehouse. The employees of the marketplaces collect and deliver each order to the end customer, i.e. the seller is only required to pack and label the goods in accordance with the requirements of the trading platform, and then deliver the products to the warehouse. In the future, the seller can adjust prices and engage in promotion – the marketplace will be responsible for everything else. FBS (Fulfillment by Seller, delivery from the seller’s warehouse) is a format of work in which the seller stores the goods in his own warehouse.

The introduction of Ensi platform services into the existing IT allowed automating the processes of connecting sellers to the marketplace: registration, onboarding, goods and stock management, support for various sales models. These platforms and others, among others, activate consumer citizens, groups of purchasers of goods, i.e. the behavior of large social groups associated with the receipt, use of money and other assets. The e-commerce market in the digital environment has shown an increase of 156% over the past year compared to the previous one and has become the most popular way for consumers to make purchases in Russia. In business, such opportunities are characterized as “something that should have been started yesterday”. The Russian Federation ranks 12th in the world in terms of the share of e-commerce from the total retail turnover with an indicator of 11.6%. ... [6].

Marketplace and its characteristics

Answering the question of why marketplaces are so popular at the moment, we will indicate the author’s position. The main thing is that marketplaces in the digital environment are popular due to convenience and low prices. The fact is that during the pandemic, the population was able to assess how many consumer problems such sites were able to close. They not only created conditions for customers to receive their products at pick-up points or at home in a lockdown situation, but also helped to save time and money.

The process of development of the world economy confirms that the e-commerce market in the digital environment has become highly competitive. In business, such an environment has been called the “Red Ocean”, which means high consolidation and literally a battle in the social field for the consumer between producers.

Such a system forces the marketplace to create its conditions more and more loyal for the consumer, just to keep him. For example, flexible discount systems, profitable subscriptions and the ability to return part of the funds for the purchase – cashback appeared on the electronic market. Competition among the players led to the fact that the consumer literally felt for himself how much more convenient and cheaper it is to buy goods online.

An attractive aspect of the high demand in the e-commerce system is convenient services and platforms. The sites are designed in such a way that they aggregate a huge number of products and adjust cross sales to an individual customer using ML. So the consumer can, without getting up from the sofa, find the thing that he needs, read the reviews left by other customers and order it in one click of the computer mouse.

Thus, marketplaces act as intermediaries between sellers and buyers, where they do not have their own products, but at the same time they invest in logistics, invest in the construction of distribution centers, warehouses and order pick-up points, thereby reducing the delivery time, and the buyer can pick up his goods within 2-3 days from the date of purchase at any convenient he needs the center or order courier delivery to his home.

A significant role is also played by high-quality UX / UI design, which involves designing convenient, understandable and aesthetic user interfaces. The interface is so simple and convenient that a consumer of any age and computer training can quickly learn how to use it, so the target audience of the Russian society of marketplaces is very wide, which obviously also affects the profit level of electronic sellers.

Today, despite the turbulent political events, the introduction of various kinds of sanctions against the Russian Federation by the West, obvious leaders of electronic commerce, such as Yandex, exist and continue to operate in our country.Market, Wildberries, Lamoda, Ozon, Beru and other well-known sites.

The structure of marketplaces

Based on a comprehensive sociological analysis, the authors of the article attempted to structure marketplaces by type. In our opinion, they may be as follows:

1. Vertical, whose task is to sell goods and services of the same type. For example, the Yoone service, Yandex Taxi Voronezh.

2. Horizontal – trade goods and services of the same orientation. For example, Beloris, Hobby Express sells everything related to entertainment.

3. Global – such as Aliexpress, Albay.ru WellBeen.ru , Ozon or Wildberries, which sell a variety of products.

The main thing here is not to confuse the marketplace with aggregator sites that only inform about a product or service and do not sell anything. To buy something, you need to follow the link to the supplier’s online store and make a purchase there, such as on Yandex.Market. Marketplaces are sold on their own website or in an application.

In the Russian Federation, marketplaces have just started and are still only mastering the Russian society, the Russian market. But according to the current growth rates, it can be predicted that within 2-3 years, marketplaces will rapidly break into the top 10 e-com and significantly change the structure of the social economy, both the top and consumption, changing the traditional habits of people.

The marketplace is a universal huge hypermarket-online with huge opportunities, in which almost all customer needs can be met. Hence, experts believe that in this market confrontation there will be a maximum of 3-5 players who will fight for the top [6].

Leaders of modern trade

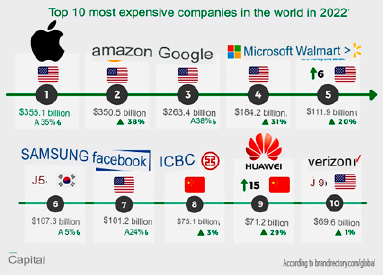

Currently, despite the fact that, as a number of magazines indicate, 7 American, 2 Chinese and 1 South Korean companies entered the Top 10 most expensive companies in the world in 2022, a serious struggle is underway. And thoughtful and adequate scientific analysis plays an important role in this struggle. In 2021, the volume of the global e-commerce market exceeded $5 trillion, and experts’ forecast by 2026 estimates it at $8 trillion.

Fig. 1. Top 10 most expensive companies in the world in 2022 (facebook’s activity in Russia is recognized as extremist)

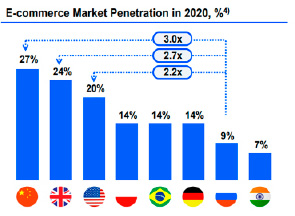

Fig. 2. Penetration into the e-commerce market in 2020, %

One of the absolute leaders of the global e-commerce market is Amazon. Amazon.com , Inc, an American multinational technology company, with a market capitalization of $1.158 trillion, ranks fifth in the world’s richest companies in the world, and its owner is Jeff Bezos, the richest man in the world. Interestingly, he founded Amazon in his garage in 1994. Initially, Amazon started as an online marketplace company, starting with the sale of books, and then expanded to sell on its online portal almost everything that is needed in the modern world, such as video games, clothing, furniture, shoes, computers and consumer electronics.

The social field itself contributes to the success of the company – a growing number of sellers and brands: 58% of the gross value of goods purchased at Amazon was sold through its online marketplace. The company has established various business lines in society, taking into account every aspect of retail trade. To promote their products, sellers willingly use the fast-growing advertising business of the retailer Amazon Advertising. Fulfillment by Amazon storage and delivery service is also in demand.

Amazon has become the absolute leader among users in the USA – already 55% of Americans start their product search with Amazon and only 15% with Google. This is something that seemed impossible 5-7 years ago: a retailer is displacing a search engine from its main market, but it is happening. It is likely that the same thing will happen in Russia [7]. Our country has made an obvious breakthrough on the battlefield called the “electronic market”, despite the recent unbridled sanctions against Russia. Yes, and China has seriously taken up arms against the American trade electronic dictate, which is seen in Fig. 2.

The company generates the main income due to the fact that it receives a commission from each sale made by the sellers of the marketplace. This remuneration is ranked from 8 to 25 percent, depending on the product category. Most items fall under a commission of 15%. Although Amazon prefers not to publish data on commission income from sales from the marketplace, it is assumed that in 2018 the retailer earned about $ 24 billion on commission, of which $16 billion was in the United States [8]. In 2021, Amazon recorded the highest revenue of $469 billion, making it the world’s largest Internet company by revenue. The company employs a record 1,608,000 employees worldwide.

Alibaba marketplace is considered a full-fledged monopolist of the Chinese e-commerce market and one of the largest companies in the world. Alibaba’s market capitalization as of April 2021 is $637 billion, making it the ninth most expensive company in the world. The company operates in three directions: b2c, b2b and c2c. All three platforms have already entered the international market (including Russia), but the main share still falls on the domestic market. The company also has its own payment system. Alibaba’s model is similar to eBay: it acts as an aggregator for sellers – individuals, stores or manufacturers – who themselves send goods to customers.

Also, many people know such players as eBay, Asos, Ozon. For 2021, the statistics of the turnover activity of marketplaces clearly in numbers shows their demand among users of Russian citizens:

• AliExpress – 35 million users, turnover for 2021 is 306 billion rubles.

• Wildberries – 113 million users, turnover for 2021 844 billion rubles.

• Ozon – 220 million orders per month, turnover for 2021 445 billion rubles.

• Yandex.Market – 9.8 million customers, 29.7 million orders, turnover for 2021 35.2 billion rubles.

Characteristics of the Russian e-commerce market

The largest Russian marketplaces sooner or later run into the ceiling of development in the local market. Consolidation is increasing, and competition, even at the level of one country, is becoming increasingly fierce and complex. Therefore, many companies have a question: “How to increase profits if the Russian market is already, in fact, divided among major players?” The race for the buyer becomes a vicious circle, where each new race means the loss of part of the company’s revenue in the desire to retain the consumer. But, there is still a solution to the problem.

Despite the sanctions imposed by the West for almost ten years, access to international markets is a special growth point for Russian companies engaged in electronic commerce, an opportunity to increase profits and brand loyalty. At the same time, companies are actively using foreign resources, for which the possibility of interaction with Russian firms is an opportunity to survive in the “battle for a place in the sun” in the face of shameless pressure from American companies. In most cases, they use a scaling model with a focus on neighboring markets.

For example, Lamoda sells clothes and shoes in Russia, Kazakhstan, Belarus. Such coverage ensures stable growth of the audience and financial indicators. And if in Russia you have to fight with 3-5 marketplaces, then, for example, in Kazakhstan the competition is much lower, i.e., not all marketplaces have settled in the CIS countries. The same Yandex.Market is only planning to expand its presence, but so far, the solution to the issue is not moving from the dead point. It is worth paying tribute to Russian marketplaces – they are not only developing rapidly within the country, but also coping well with global expansion. Wildberries has succeeded especially noticeably in this regard.

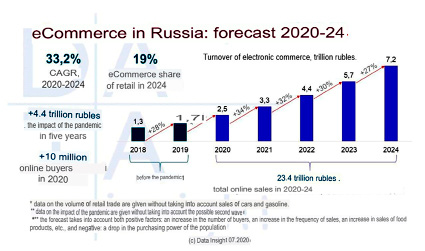

The forecast of the development of e-commerce in Russia in a difficult, turbulent time of sanctions still has a positive basis (Figure 3).

Fig. 3. Forecast of e-commerce market volume in Russia

Having received a powerful incentive to grow in a pandemic, e-commerce continues to develop in Russia’s new consumer positions. In Russia, the general trends in the e-commerce market remained the same as in world practice, although it must be admitted that the pace of online sales in 2022 slowed down due to the unstable economic situation, sabotage, openly hostile attitude of some Western countries, and other factors, but still they (the pace) did not they stopped.

According to the Association of Online Trading Companies (AKIT), in the 1-st half of 2022, the volume of online purchases in money amounted to 2.3 trillion rubles – this is 1.5 times more than in the same period of 2021. And in the total volume, the share of e-Commerce retail sales increased from 8.8% to 11.2%. Residents of Moscow, the Moscow region and St. Petersburg made the most orders.

The most popular orders are electronics and household appliances (every fifth online order). Furniture and household goods account for 17.7%, while clothing and footwear account for 13.9%. Also, the five most popular custom categories in e-commerce included food (eGrocery), as well as health and beauty products.

Cosmetics trade occupies a special place in electronic commerce. Modern Russian cosmetics production has a very short history, only about 25 years. Approximately this ratio is standard for the markets of those countries of the world where multinational corporations occupy the dominant positions.

The withdrawal of many foreign brands from the cosmetic market gave Russian cosmetics manufacturers a new chance to prove themselves. There are about 600 companies in the country that produce cosmetics and perfumes, there are about 200 production sites that are actively working, including as contract manufacturers.

But, in total, they account for no more than 0.3% of the global turnover of the industry, mainly due to the low price of products. The total volume of sales of Russian cosmetics, according to our association, in 2021 amounted to 132 billion rubles.

The first serious chance for domestic companies was given by the crisis of 1998. It was then that the foundation of the current industry appeared. By the early 2000s, market shares in the turnover of imported and local products were determined: about 70% were provided by international companies, primarily L’Oreal, Unilever, Schwarzkopf, Colgate, P&G, Henkel, Wella, and small foreign players. At that time, the Federal Law “On Electronic Commerce” was adopted (adopted by the State Duma of the Russian Federation in the first reading by Resolution N1582-III of the State Duma of June 6, 2001) [9].

In total, all these five categories account for more than 60% of all online purchases. The most dynamic growth is shown in the online trading marketplaces: Wildberries, Ozon, Yandex.Market, AliExpress and Sbermegamarket. In general, their share in e-commerce in the 1st half of 2022 increased to 47.9% – in 2021 it was 39.7%. Therefore, in the long-term forecasts of the turnover of electronic commerce in Russia, to a greater extent, optimism is visible (Fig. 4).

Fig. 4. e-Commerce in Russia: forecast 2020-24

At the same time, according to Data Insight analysts, in the context of a special military operation in Ukraine, the growth of the online trading market in Russia has slowed down. Until February 2022, it added more than 100% year-on-year in each month, but later the pace dropped to 60-65%, and in August – to 55%. Analysis of statistical data shows that demand in the Russian online trading market was undulating: after the March rush, the decline began, the situation stabilized in the summer, and in the autumn, against the background of the announcement of partial mobilization and the hasty departure of part of the Russian population and migrant citizens, eCommerce demand again slowed down somewhat. In general, marketplaces in Russia continue to grow rapidly – for the 1st half of 2021, 675 million orders were made in the domestic e-commerce market (+94% by the same period in 2020) in the amount of 1,750 billion rubles (+47%) [4].

According to Data Insight, for the current situation in Russia, there are changes in the consumer behavior of Russians. So, almost 40% of Russians began to buy less, including online, 6% began to buy more and now they mostly do it via the Internet. People have a shortened planning horizon due to the state of uncertainty, familiar and beloved brands that need to be replaced are leaving, and the popularity of remote work is growing. All this pushes the e-commerce market to active development, while offline outlets are losing sales in quantity.

This direction of development is very profitable for sellers. They can enter new markets with minimal costs. If it is possible to gain a foothold on one site, it will remain to adapt the processes to the new region.

Problems of adaptation of electronic commerce in the international market

Any business initiative, expansion of a new market is inextricably linked with risks. It should be taken into account that access to any region is associated with a direct study of the habits of the population – that is, our potential customers. In order to avoid problems and find possible solutions in advance, entrepreneurs most often resort to such things as customer development interviews and analysis of best practices, but it is also important to take into account unsuccessful expansions, as well as to understand the mistakes of predecessors.

Electronic trading platforms are becoming more global and international. The opportunity to meet demand abroad is one of the greatest opportunities for sellers on trading platforms around the world. Developing countries remain the most profitable for expansion (from a commercial point of view in the short term), since there are simply no analogues of such sites there. This “piece” of the global e-commerce market can be a good start and bring high profits if the entrepreneur builds the business correctly and takes into account all possible risks, including logistics and marketing. Thus, the growth of retail e-commerce sales in North America amounted to 31.8%, in Latin America 36.7%, in Central and East Africa 19.8%. The average global growth was 27.6%11. Access to highly consolidated markets (USA, China, Europe) carries a huge risk, but the possible gain of the player is much greater.

Conclusion

The e-commerce market in the context of the growing digital environment is undoubtedly striving for improvement, online stores are increasing efforts to ensure that the buying process is not only as fast and comfortable as possible, but also fascinating. It is clear that this process is becoming a challenge for classical marketing. In the context of the growing digital environment, the electronic market faces the challenges of creating a publicly accessible, stable and secure information and telecommunications infrastructure for high-speed transmission, processing and storage of large amounts of data.

In our opinion, the time is not far off when e-commerce will reach a new technological level: mobile applications will gradually replace all other online sales channels – smart voice assistants, AR applications for fitting rooms, as well as payment using PayPass will come to the aid of consumers.