Considering the production activity of the timber industry complex, one can note the fact that this industry is characterized by constant variability. If in 2020 there was a decrease in the pace of production of timber products, then in 2021 there was an increase in the pace of production for woodworking products, this was most caused by an increased demand for raw materials for wooden housing construction.

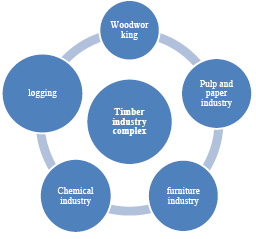

The structure of enterprises of the timber industry complex is represented mainly by 5 areas (Figure 1).

In 2020, on average, the statistical authorities observed a decrease in the production of wood products by 4.4%, the total production of which amounted to 28.7 million m3. For example, plywood and board production also shows a decrease in production, in which the decrease was 3%. One of the most popular products in the woodworking industry is fiberboard and chipboard, the production rate of which is characterized by an observed decrease of 7.1% and 1.5%, respectively. Against the background of these changes in 2020, there was a shortage of chipboard in the domestic market by the end of 2020.

Fig. 1. The structure of the timber industry complex of the Russian Federation

But it is worth noting that one of the most massive types of production in terms of volume is the pulp and paper industry, where in the same period there is a policy of retaining the production of paper and cardboard products, since during the pandemic period there was a jump in demand for packaging paper products and cardboard [1,2].

The purpose of the study is to develop and determine the most effective approaches aimed at attracting financial resources to the innovative activities of timber industry enterprises.

Material and research methods

The article uses a forecasting methodology that allows taking into account the impact of crisis and sanctions factors. In 2021, on the contrary, there is an increase in production indicators, where the index of industrial production of timber products amounted to 105.3% compared to 2020. The production index of the woodworking industry was 107.9% in 2021. In turn, the pulp and paper industry is also characterized by a positive change, where the production index amounted to 103.5%.

In just one calendar year, prices for woodworking products, in particular, the production of sawn timber, and for a number of other timber products have almost doubled. The increase in prices was caused by a shortage of sawn timber both in the domestic and foreign markets and an increase in the export of Russian wood and timber raw materials.

Results of the research and discussions

Table 1 examines the data on the allocation of funds for fundamental and applied scientific research in the structure of federal budget expenditures for 2017-2020 and forecast 2021-2023 [1-3].

According to Table 1, it can be concluded that, under current conditions, research costs from various funding sources will increase. The largest share of funds from the federal budget is planned to be directed to applied research, if in 2020 financial resources were allocated in the amount of 346355.4 million rubles, then in the forecast period already 455513.1 million rubles. At the same time, the total amount of funding for applied and fundamental research may amount to 744,670.7 million rubles [1-3].

In order to support the industry, the Government of the Russian Federation has developed a number of measures aimed at reducing prices and the shortage of woodworking products. So, from July 1, 2021, new duties have been introduced for the export of timber products with a moisture level of 22% or more from the territory of the Russian Federation; it is also planned to ban the export of round wood from January 1, 2022 [3,4].

Table 2 presents indicators reflecting the funding of scientific research at the enterprises of the timber industry complex for 2017-2020 and forecast 2021-2023.

Table 1

Indicators of allocation of financial resources for fundamental and applied scientific research

|

Indicators |

Periods |

Forecast values of periods |

||||

|

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

|

Basic scientific research (fed. budget), million rubles |

149550,0 |

192495,0 |

203246,8 |

235460,7 |

262309,1 |

289157,5 |

|

Applied scientific research (fed. budget), million rubles |

270922,3 |

296663,1 |

346355,4 |

380080 |

417796,6 |

455513,1 |

|

Total: |

420472,3 |

489158,1 |

549602,2 |

615540,8 |

680105,7 |

744670,7 |

|

In the structure of federal budget expenditures, % |

2,52 |

2,69 |

2,41 |

2,43 |

2,375 |

2,32 |

|

In the structure of VVP, % |

0,40 |

0,44 |

0,51 |

0,56 |

0,615 |

0,67 |

|

Funding for research and development, total for the country: |

960689,4 |

1060589,7 |

1091333,5 |

1168182 |

1233504 |

1298826 |

|

fundamental scientific research, million rubles |

169175,0 |

181371,9 |

205227,9 |

221311,2 |

239337,6 |

257364,1 |

|

Applied scientific research, million rubles |

197209,3 |

213363,3 |

218491,5 |

230970,2 |

241611,3 |

252252,4 |

|

Development, million rubles |

594305,2 |

665854,6 |

667614,1 |

715900,2 |

752554,7 |

789209,1 |

Source: compiled by the author according to Rosstat.

Table 2

Indicators reflecting research funding at the enterprises of the timber industry complex

|

Indicators |

Periods |

Forecast values of periods |

||||

|

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

|

Costs in the structure of VVP, % |

1,00 |

1,04 |

1,10 |

1,150 |

1,207 |

1,265 |

|

Costs associated with financing science and innovative activities of organizations, by areas, million rubles, total: |

37 199,90 |

23 259,20 |

36 480,50 |

30992,13 |

30690,99 |

30392,78 |

|

Woodworking enterprises, mil.rub. |

3 042,3 |

7 943,7 |

5 891,8 |

10112,77 |

14073,21 |

19584,66 |

|

Pulp and paper enterprises, mil.rub. |

33 878,6 |

14 829,6 |

30 490,0 |

22351,29 |

21204,04 |

20115,68 |

|

Furniture enterprises, mil.rubles |

279,0 |

485,9 |

98,7 |

83,985 |

49,953 |

29,711 |

|

Share of costs in the structure of total funding for research and innovation, % |

||||||

|

Woodworking organizations, % |

0,72 |

1,62 |

1,07 |

1,600 |

1,951 |

2,378 |

|

Pulp and paper organizations, % |

8,06 |

3,03 |

5,55 |

3,537 |

2,935 |

2,436 |

|

Furniture organizations, % |

0,07 |

0,10 |

0,02 |

0,015 |

0,008 |

0,004 |

Source: compiled by the author based on Rosstat data and forecasting.

Table 3

Indicators reflecting the level of innovative development

|

The value of the level of innovative activity, % |

|||||

|

Woodworking enterprises, % |

8,3 |

10,6 |

7,2 |

7,8 |

93,98 |

|

Pulp and paper enterprises, % |

15,2 |

20,3 |

14,7 |

17,9 |

117,76 |

|

Furniture enterprises, % |

6,9 |

20,1 |

17,4 |

12,6 |

182,61 |

|

The volume of innovative products, million rubles |

|||||

|

Woodworking enterprises, million rubles |

7 476,7 |

14 498,3 |

8 238,9 |

9 944,4 |

133,01 |

|

Pulp and paper enterprises, million rubles |

41 626,0 |

36 599,1 |

31 946,1 |

14 055,7 |

33,77 |

|

Furniture enterprises, million rubles |

2 251,9 |

3 350,9 |

1 464,2 |

3 536,6 |

157,05 |

Source: compiled by the author according to Rosstat.

The predictive values in Table 2 were calculated based on a linear approximation methodology. According to the calculations, in general, the costs associated with the financing of science and innovative activities of timber enterprises tend to decrease. The reduction can be obtained in the direction of the pulp and paper industry, where, according to the forecast data, innovation financing may amount to 20115.7 million rubles. in 20203, compared to 2020, where the costs amounted to 30490 million rubles. The same is true in the furniture sector, where, according to forecast data, there will be a decrease in financing costs in innovation. Table 3 presents indicators reflecting the level of innovative development.

The activities of a significant part of the timber industry enterprises and organizations are aimed at obtaining the maximum financial result and increasing labor productivity, associated with a reduction in production costs, expanding sales markets, improving product quality, and reducing the number of physically and morally obsolete equipment [5-7].

To determine the dynamics of indicators that determine the innovative development of timber enterprises, the methodology of deterministic factor analysis was applied, the initial data for the necessary calculations are presented in Table 4.

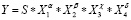

An economic-mathematical model that reflects the level of provision of innovations at enterprises will take into account the necessary indicators of innovative development, namely, the dynamics of research funding in the structure of GDP, the dynamics of costs associated with financing innovative activities, as well as the volume of innovative products and the level of innovative activity of forestry enterprises. Based on this, the model will look like this:

In this model, the dependent variable (Y) reflects the influence of the indicator that determines the financing of scientific research in the structure of VVP (%) [8-10].

For independent variables (X), the following indicators are used:

– The amount of costs associated with the financing of science and innovative activities of organizations, by areas of activity (million rubles) [11,12];

– The amount of costs associated with the financing of science and innovative activities of organizations, by areas of activity (million rubles) [11,12];

– The share of costs in the structure of the total volume of financing of scientific research and innovation (%) [13,14];

– The share of costs in the structure of the total volume of financing of scientific research and innovation (%) [13,14];

– The volume of innovative products (million rubles) [15, 16];

– The volume of innovative products (million rubles) [15, 16];

– The level of innovative activity (%) [17].

– The level of innovative activity (%) [17].

Table 4

Forecast data for building an economic and mathematical model

|

Period |

Financing of scientific research in the structure of VVP, %, Y |

Costs associated with financing science and innovative activities of organizations, X1 |

Share of costs in the structure of total funding for research and innovation, %, X2 |

The volume of innovative products, million rubles, X3. |

Level of innovation activity, %, X4 |

|

Woodworking enterprises |

|||||

|

2020 |

0,0034 |

3996,06 |

0,64 |

10438,98 |

7,3 |

|

2021 |

0,0026 |

3185,75 |

0,45 |

10746,67 |

6,9 |

|

2022 |

0,0019 |

2539,76 |

0,31 |

11063,43 |

6,5 |

|

2023 |

0,0015 |

2024,75 |

0,22 |

11389,53 |

6,1 |

|

Pulp and paper mills |

|||||

|

2020 |

0,0348 |

41 214,10 |

6,58863 |

12 313,43 |

17,6 |

|

2021 |

0,0452 |

56 442,67 |

7,94076 |

8 770,42 |

17,9 |

|

2022 |

0,0588 |

77 298,20 |

9,57038 |

6 246,85 |

18,2 |

|

2023 |

0,0764 |

105 859,83 |

11,5344 |

4 449,41 |

18,5 |

|

Furniture enterprises |

|||||

|

2020 |

0,0001 |

125,95 |

0,02 |

2851,75 |

20,0 |

|

2021 |

0,0001 |

95,53 |

0,02 |

3005,84 |

23,6 |

|

2022 |

0,0001 |

72,46 |

0,01 |

3168,26 |

27,9 |

|

2023 |

0,0000 |

54,96 |

0,01 |

3339,46 |

32,9 |

Source: Author’s own calculations.

Table 5

Components of the economic and mathematical model

|

Direction of activity |

Components |

Exponent α at the independent variable, «X1» |

Exponent β at the independent variable, «X2» |

Exponent of the independent variable, «X3» |

Exponent of the independent variable, «X4» |

|

Woodworking enterprises |

0,0086 х |

0,85 |

2,0 |

1,1 |

0,85 |

|

Pulp and paper mills |

0,0207 х |

2,1 |

4,7 |

3,1 |

1,7 |

|

Furniture enterprises |

0,0003 х |

0,03 |

0,07 |

0,27 |

1,4 |

Source: Compiled by the author.

Conclusion

The application of the constructed economic-mathematical model for various production lines of activity of the enterprises of the timber industry complex (woodworking enterprises, pulp and paper and furniture enterprises) will make it possible to determine the dependence of the level of innovative development of each production line of activity and the degree of financing of scientific research and innovation (Table 5).

According to the calculations obtained in the course of assessing the provision with innovations, according to Table 5, we can conclude that the highest level of provision with innovations is characterized by the pulp and paper industry, where during the analyzed periods there is an average and moderate level of provision with innovations, then we can note the woodworking industry, demonstrating a lower dynamics.

Библиографическая ссылка

Shanin I.I. MAIN WAYS OF FINANCING INNOVATIVE ACTIVITIES OF FOREST INDUSTRY // European Journal of Natural History. 2022. № 6. С. 21-25;URL: https://world-science.ru/ru/article/view?id=34300 (дата обращения: 07.02.2026).

DOI: https://doi.org/10.17513/ejnh.34300

х

х х

х х

х

х

х х

х х

х

х

х х

х х

х